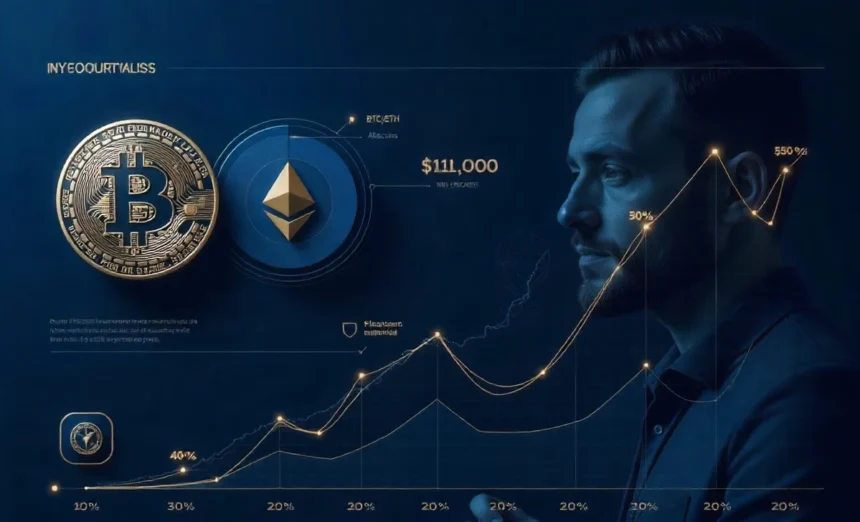

The crypto market has matured significantly, with Bitcoin reaching a new all-time high of $111,000 in May 2025 and increasing institutional adoption. Learning how to diversify a crypto portfolio requires careful planning and safe crypto investing strategies 2025 to navigate volatility while capturing growth opportunities. This guide provides beginner and intermediate investors with proven crypto portfolio tips and the best crypto allocation for beginners in today’s evolving crypto landscape.

Why Portfolio Diversification in Cryptocurrency Matters

Risk management in blockchain investments carries unique risks that make portfolio safety crucial. Undiversified crypto portfolios expose investors to extreme volatility, potential rug pulls, and sudden market crashes that can wipe out entire positions overnight.

The difference between chasing hype coins and building long-term crypto portfolio wealth lies in strategic planning. While meme coins and trending tokens might offer quick gains, they often lack sustainable value propositions and can collapse rapidly.

According to recent regulatory developments, the SEC’s approval of Ether ETF options demonstrates growing institutional confidence, but this doesn’t eliminate the need for careful risk management. Smart investors follow proven crypto portfolio tips to focus on building resilient portfolios rather than gambling on speculative assets.

Core Principles of a Safe Crypto Portfolio in 2025

Understanding Crypto Asset Classes Explained

A well-balanced crypto portfolio spreads investments across multiple categories to reduce risk. Your allocation should include:

Bitcoin and Ethereum as core holdings: form the foundation. These established assets have proven track records and strong network effects. Bitcoin’s recent peak at $111,000 shows its continued relevance as digital gold, while Ethereum dominates smart contract platforms.

Stablecoins for risk management: such as USDC, USDT, and DAI provide liquidity and stability. They serve as safe harbors during market downturns and enable quick repositioning when opportunities arise.

Safe way to invest in altcoins: includes large-cap options like Solana (SOL), Cardano (ADA), and Polygon (MATIC) with strong fundamentals. These projects offer growth potential beyond Bitcoin and Ethereum while maintaining established track records.

Emerging sectors: like DeFi tokens, Real-World Assets (RWA tokens), and Layer 2 solutions represent new opportunities. Tokenized gold products alone reached a $1.54 billion market cap in 2025, showing growing interest in asset tokenization.

A suggested allocation might look like: 40% Bitcoin/Ethereum, 30% stablecoins, 20% large-cap altcoins, and 10% experimental projects.

Balancing High-Risk and Low-Risk Crypto Assets

Understanding risk levels helps you assign appropriate portfolio weights. High-risk tokens might offer greater rewards but should represent smaller portions of your holdings. These crypto portfolio tips help balance potential returns with safety.

Conservative investors might prefer 50% BTC/ETH, 30% stablecoins, and 20% carefully selected altcoins. More aggressive investors could reduce stablecoin allocation while increasing exposure to emerging sectors. This approach demonstrates how to protect against crypto volatility through proper allocation.

Your risk tolerance should determine these percentages, but never invest more than you can afford to lose completely.

Considering Regulation and Security in 2025

Regulatory clarity has improved significantly in 2025. The SEC approval of various crypto products and regulated crypto exchanges 2025 compliance requirements reduce regulatory uncertainty. The US Congress is working on comprehensive stablecoin legislation combining the Senate’s GENIUS Act and the House’s STABLE Act.

Choose regulated platforms like Coinbase, Kraken, or Gemini that comply with KYC and AML requirements. While this might seem restrictive, regulated platforms offer better protection against fraud and market manipulation.

Safe Storage of Cryptocurrency

Storage security remains critical for portfolio safety. Understanding cold wallet vs hot wallet storage helps protect your investments. Hot wallets like MetaMask connected to the internet offer convenience for trading but expose funds to hacking risks.

Cold wallets such as Ledger Nano and Trezor store private keys offline, providing superior security for long-term holdings. Hardware wallets represent the gold standard for secure crypto investment tips, keeping private keys isolated from internet-connected devices.

Exchange hacks continue to occur, making self-custody important for larger holdings. Only keep funds you’re actively trading on exchanges, and transfer long-term investments to secure storage.

Practical Steps to Build Your 2025 Crypto Portfolio

Step 1: Define Your Investment Goals

Clear goals guide portfolio construction. Understanding long-term vs short-term crypto portfolio strategies helps determine your approach. Long-term wealth building requires different strategies than short-term trading.

For newcomers to the space, it’s essential to understand basic investment principles before building complex portfolios. Determine your time horizon and risk tolerance. Are you saving for retirement in 20 years or looking for gains within two years? Your timeline affects asset allocation and rebalancing frequency.

Decide what percentage should focus on growth versus stability. Younger investors might emphasize growth, while those nearing retirement might prioritize capital preservation with stablecoins.

Step 2: Research Before Buying

Thorough research prevents costly mistakes. Read project whitepapers to understand technology and tokenomics. Active communities and regular development updates indicate healthy projects. Following these crypto portfolio tips protects against poor investment choices.

Use multiple sources including trusted analysts, community forums, and official documentation. Be skeptical of projects promising unrealistic returns or lacking technical details.

Avoid “pump-and-dump” signals from social media influencers. These schemes artificially inflate prices before insiders sell, leaving followers with losses.

Step 3: Start Small and Scale

Dollar-cost averaging crypto 2025 reduces timing risk by spreading purchases over time. Instead of investing a lump sum, regular smaller investments smooth out price volatility and represent one of the best crypto investment for beginners strategies.

For example, investing $100 weekly performs better than $400 monthly during volatile periods. This approach removes emotion from buying decisions and builds positions gradually.

Start with small amounts until you’re comfortable with the process. Increase investment size as your knowledge and confidence grow.

Step 4: How to Rebalance Crypto Holdings

Portfolios drift from target allocations as asset prices change. A token that was 10% of your portfolio might grow to 25%, increasing concentration risk.

Rebalancing strategies involve selling overweight positions and buying underweight ones to restore target percentages. This forces you to sell high and buy low, improving long-term returns.

Consider rebalancing quarterly or when allocations drift more than 5-10% from targets. More frequent rebalancing might incur excessive trading costs. These essential crypto portfolio tips ensure your strategy stays on track over time.

Crypto Portfolio Mistakes to Avoid

Over-investing in meme coins remains a major pitfall. While these tokens can generate spectacular short-term gains, they rarely maintain value long-term. Treat meme coin investments as entertainment rather than serious portfolio components.

Ignoring stablecoins limits portfolio flexibility. Stablecoins provide liquidity for opportunities and reduce overall volatility. They’re not exciting, but they serve important portfolio functions.

Leaving funds on exchanges long-term exposes you to counterparty risk. Exchanges can be hacked, frozen by regulators, or become insolvent. Use exchanges for trading, not storage.

Not accounting for tax implications can create problems. Crypto transactions often generate taxable events. Keep detailed records and understand your jurisdiction’s tax requirements.

Conclusion

Building a safe crypto portfolio in 2025 requires diversification across asset classes, balanced risk management, secure storage practices, and regular rebalancing. These crypto portfolio tips include spreading investments among blue-chip cryptos, stablecoins, and promising altcoins while avoiding over-concentration in speculative assets.

Market outlook for 2025 remains positive, with institutional adoption growing and regulatory clarity improving. ARK Invest recently raised its Bitcoin price forecast for 2030 from $1.5 million to $2.4 million, reflecting long-term confidence in crypto’s potential.

FAQs: Safe Crypto Portfolio 2025

What is the safest crypto to hold long-term?

Bitcoin and Ethereum historically show the most stability among cryptocurrencies. They have the largest networks, most institutional support, and longest track records.

Should I invest in stablecoins?

Yes, stablecoins reduce portfolio volatility and provide liquidity for opportunities. They act as safe harbors during market downturns while keeping funds deployed in crypto.

How much of my savings should go into crypto?

Only invest what you can afford to lose completely. Many financial advisors suggest 5-15% for beginners, though this depends on individual circumstances and risk tolerance.

Is diversification still necessary if I only hold BTC and ETH?

Yes, adding stablecoins and select altcoins can reduce risks and increase flexibility. Even blue-chip cryptos remain volatile, so diversification across crypto categories helps smooth returns.